Upload borrower’s last 3 years of financial statements

For Chief Credit Officer, Loan Managers & Director of Business Lending, Commercial Real Estate Lenders, Non-Bank Lenders, FinTechs & Small business Lenders

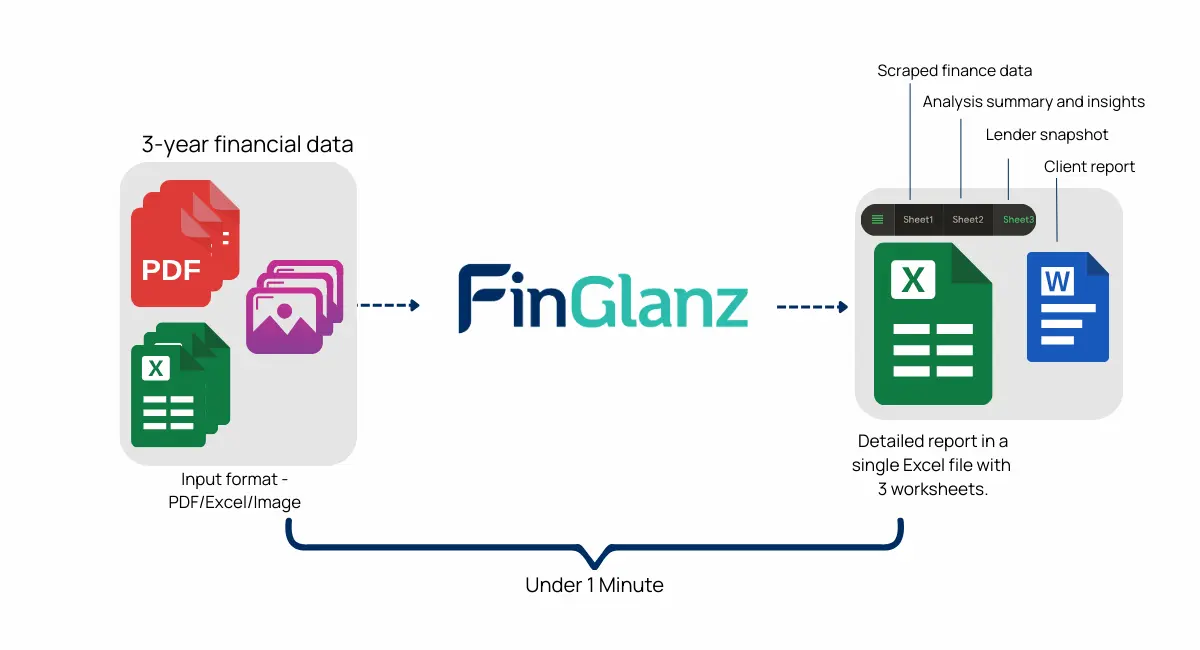

Analyse 3 years of financial data in under a minute.

Assessing P&L/IT reports is boring, time-consuming and sometimes frustrating. We made it easy. Book a product intro below.

- SOC 2 Compliant

- ISO27001 Compliant

- GDPR Compliant

- No data stored, ever (input or output)

Analyse 3 years of financial data in under 1 minute

Significantly reduce operational cost in analysis

Increase capacity to handle much larger volumes of applications

Boost market share by winning broker business faster

- Challenges in Commercial Lending

The hidden cost of a bottlenecked financial analysis process

Every extra hour in processing time means lost deals, lost revenue, and shrinking market share.

Hours spent on manual work

Hours spent on manually extracting financial data, insights and writing credit submissions

Expert staff do repetitive tasks

High salaries paid for experienced staff to do repetitive, manual analysis

Complex deals get sidelined

Complex deals get sidelined Complex deals go into the too hard basket because there is simply too much data to review

Approvals are capped by system inefficiency

A limitation on the number of applications that can be processed per day

Before / After: Your financial analysis process

Before (Manual Process)

- 2–5 hours per application on average

- Multiple spreadsheets, manual data capture & manual calculations

- Risk of human error and inconsistent analysis

- Brokers move on to faster lenders

After With (FinGlanz)

- Full analysis in under 1 minute

- Standardised, lender-ready Excel report (3 detailed worksheets)

- Higher accuracy and consistency

- Win broker trust, grow your market share

From file upload to full financial analysis in under 1 minute

FinGlanz extracts and analyses the data using AI then generates a detailed report

Download your lender-ready report with data outputs, insights, key ratios and Snapshot report

The competitive edge commercial lenders need

It’s clear! Those who use FinGlanz are more likely to win more business. Those who continue to use their manual processes, will be left behind.

- Significantly faster application processing

- Lower operational costs

- More broker referrals

- Win deals faster than competitors

Who is most likely to benefit from using FinGlanz

Banks & Commercial Lenders

Commercial Real Estate Lenders

Leasing & Equipment Finance

FinTech & SME Lenders

Credit Managers, Heads of Credit, Loan Managers & Directors

Non-Bank Commercial Lenders

Schedule a product intro now

As this is a revolutionary product, we are already getting a lot of inquiries. To manage the demand, we will be working on a first come-first serve basis. Schedule your product intro now to avoid the waitlist.

- FAQs

Frequently asked questions

FinGlanz does not store any of your financial inputs or the generated report. It ingests the data, analyses, outputs then purges the data immediately. This makes FinGlanz security compliant with GDPR, ISO 27001, SOC 2 and the New Zealand Privacy Act 2020.

You can upload PDFs, clear quality image files and Excel sheets from Xero, MYOB, QuickBooks, and similar tools.

Yes. FinGlanz is simple and easy to use. We provide full onboarding and training for you and your team, as well as providing you with support throughout the process.

Yes – it is completely customised to your needs. The output metrics, insights and even the snapshot report is as per your requirements.

Just click the link to schedule a product introduction. One of our team members will walk you through FinGlanz’s features and functions.

Copyright © 2025 FinGlanz